Analysis of the Effect of Loan to Deposit Ratio, Return on Asset and Debt to Equity Ratio on Stock Returns (Case Study on Financial Technology Companies Listed on the Indonesian Stock Exchange 2018-2023)

Dublin Core

Title

Analysis of the Effect of Loan to Deposit Ratio, Return on Asset and Debt to Equity Ratio on Stock Returns (Case Study on Financial Technology Companies Listed on the Indonesian Stock Exchange 2018-2023)

Creator

Zena Muklis Zazuli

Proceedings Item Type Metadata

meta_title

Analysis of the Effect of Loan to Deposit Ratio, Return on Asset and Debt to Equity Ratio on Stock Returns (Case Study on Financial Technology Companies Listed on the Indonesian Stock Exchange 2018-2023)

Abstract/Description

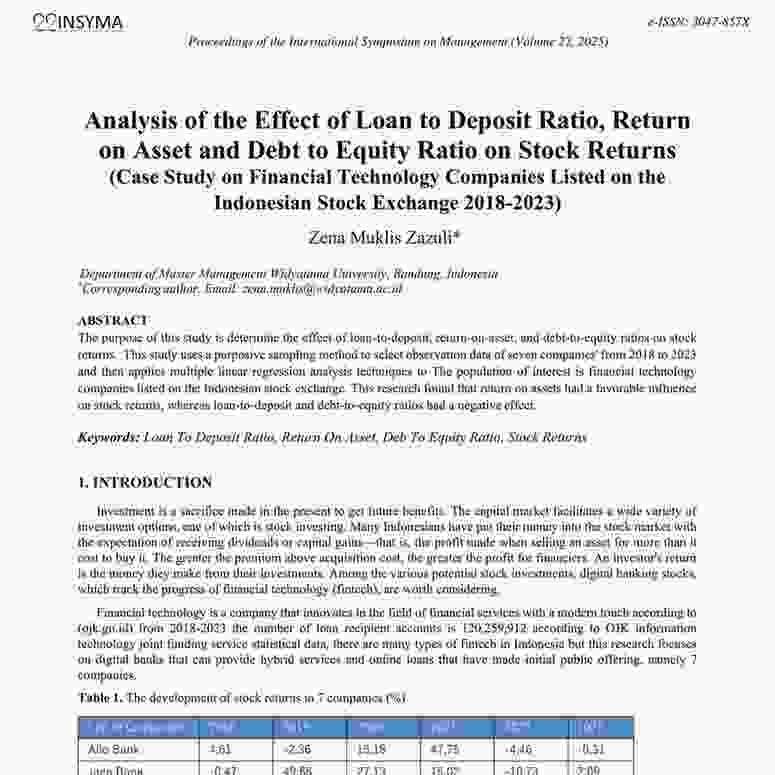

The purpose of this study is determine the effect of loan-to-deposit, return-on-asset, and debt-to-equity ratios on stock returns. This study uses a purposive sampling method to select observation data of seven companies' from 2018 to 2023 and then applies multiple linear regression analysis techniques to The population of interest is financial technology companies listed on the Indonesian stock exchange. This research found that return on assets had a favorable influence on stock returns, whereas loan-to-deposit and debt-to-equity ratios had a negative effect

publication_date

2025/06/15

pdf_url

https://insyma.org/proceedings/files/articles/Zena Muklis Zazuli.pdf

abstract_html_url

https://insyma.org/proceedings/items/show/327

keywords

Loan To Deposit Ratio, Return On Asset, Deb To Equity Ratio, Stock Returns

firstpage

92

lastpage

97

issn

3047-857X

conference

Proceedings of the International Symposium on Management (INSYMA)

Volume

22

publisher_name

Fakultas Bisnis dan Ekonomika, Universitas Surabaya

no article

16

Citation

Zena Muklis Zazuli, “Analysis of the Effect of Loan to Deposit Ratio, Return on Asset and Debt to Equity Ratio on Stock Returns (Case Study on Financial Technology Companies Listed on the Indonesian Stock Exchange 2018-2023),” Proceedings of the International Symposium on Management (INSYMA), accessed February 24, 2026, https://insyma.org/proceedings/items/show/327.